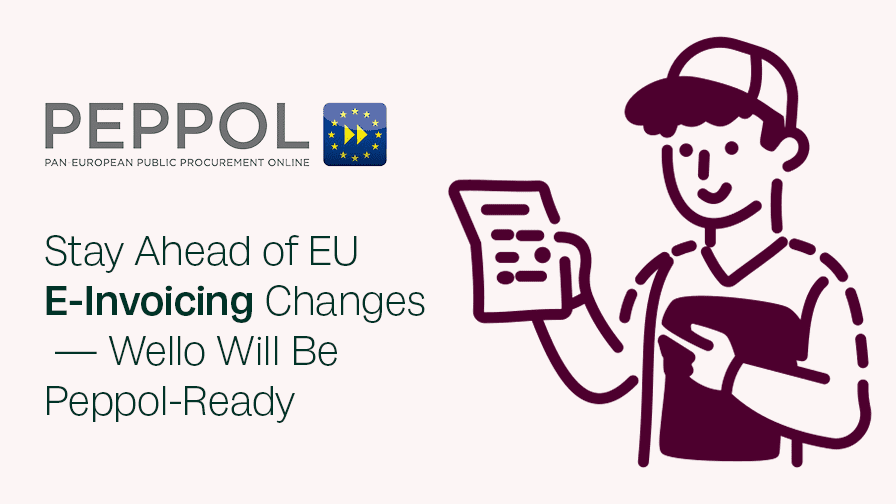

Wello Keeps You Compliant

Hi there,

We want to let you know about an important change coming in 2026 that will affect how businesses across the European Union send and receive invoices. The good news? Wello is already working on a simple solution so you’ll be ready without needing to do anything extra.

What’s Changing?

From January 1, 2026, businesses in the EU will no longer be allowed to send invoices as PDFs or on paper for business-to-business (B2B) transactions. Instead, invoices will need to be sent in a digital format called Peppol, which is an XML format.

This change is part of a new EU rule to make invoicing more consistent and easier to process for both businesses and governments. With this new format, invoices can be read by software and tax systems automatically—no need for manual handling.

The new rule will apply to:

- Businesses based in EU countries

- Invoices sent to other businesses within the same country

It doesn’t apply to B2C (business-to-consumer) transactions, and not all international companies are included. But if your company is based in the EU and you send invoices to other businesses, this change will likely affect you.

How Wello Will Help

To make this easy, Wello is adding support for Peppol e-invoicing directly into our Invoice Module. Starting in October 2025, you’ll be able to create Peppol-compliant invoices in the same way you create invoices today—right from your existing Wello workspace.

You’ll still be able to send invoices as PDFs for your records or your clients’ convenience, but Wello will also generate the required Peppol XML version in the background, so you stay within the new rules.

There’s no need to sign up for anything new, no outside tools to manage, and no extra steps. We’ll take care of the changes so you can keep working the way you always have.

A Quick Look at the Invoice Module

If you’re already using the Wello Invoice Module, you know how simple it is to create invoices based on service contracts or work orders, time worked, and parts used. You can send invoices to your clients, issue credit notes when needed, and track everything in one place.

If you haven’t tried it yet, this might be a good time to start. The module is easy to use and helps you keep your billing clear, fast, and under control—plus, it’ll be ready for the 2026 changes.

What’s Coming Next

Later on, between 2028 and 2030, the EU also plans to introduce real-time reporting. That means businesses will need to send invoice data directly to tax authorities as soon as the invoice is issued. This isn’t required yet, but it’s something we’re already keeping in mind.

As always, Wello will keep things simple. We’ll share updates as they come and make sure the tools you use grow along with the rules.

Need Help?

If you have any questions about the upcoming changes or would like help using the Invoice Module, our team is here for you. Just reach out—we’ll be happy to guide you.

Thanks for being part of the Wello community. We’re here to make your work easier, not harder—and that includes getting ready for what’s next.